On May 26, the Departments of Health and Human Services, Labor and Treasury issued FAQs clarifying out-of-pocket (OOP) cost-sharing limits within family coverage, which are required as part of the Affordable Care Act (ACA). Specifically, the in-network individual OOP maximum will apply to each individual enrolled in family coverage. The FAQs confirm that the limits will apply to all non-grandfathered plans, including large and small group self-funded plans and large group insured plans, for plan years beginning on or after January 1, 2016. Previous guidance confirmed the limits also apply to all qualified insured small group plans, as well as plans offered on public exchanges.

For 2016 plan years, the in-network OOP maximum cost share cannot exceed $6,850 for self-only coverage and $13,700 for family coverage. In-network OOP maximums may be lower than the ACA limits. This means that once a person covered under a family plan reaches his or her individual OOP maximum, all covered expenses for that individual must be paid at 100% plan coinsurance (no customer cost-share), even when the family OOP maximum may not have been satisfied. Once the family OOP maximum is reached, the plan must pay 100% of all covered expenses regardless of whether each person covered has reached the individual OOP maximum.

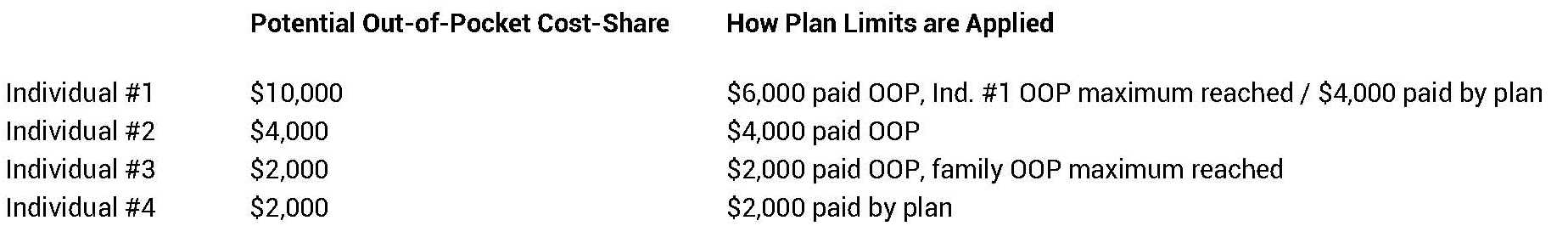

Example: Family of four with $6,000 individual/$12,000 family OOP maximum.

For illustration purposes, it is assumed the expenses are incurred in this order from top to bottom

The FAQs confirm that these maximum OOP rules also apply to high deductible health plans (HDHPs) with Health Savings Accounts (HSAs). Such plans that are effective on or after January 1, 2016 must continue to have a “collective” family deductible, to which all covered family members’ qualified expenses apply, as well as the “non-collective” individual OOP maximums. The OOP maximums for HDHPs with HSAs are different than those that apply to other types of plans and are $6,550 for self-only coverage and $13,100 for family coverage for 2016.

Additional information can be found at the CMS FAQ page which can be found on this link: FAQs

Peter Marathas is a partner in the Employee Benefits, Executive Compensation & ERISA Litigation Practice Center and heads both the Employee Benefits Practice in the Boston office and Marathas, Barrow and Weatherhead LLP's Health Care Reform Task Force. Peter is also a die-hard Red Sox fan from Boston.