What is CorePlus?

CorePlus is a transformative, all-inclusive health insurance solution that:

- Lowers costs for employers

- Lowers costs for employees

- Provides price certainty

- Improves quality of care

- Gets rid of overinsurance: add-on insurance only when you need it

- Brings simplicity and ease

Who is CorePlus for?

Employers with 300+ employees who are:

- Ripe for a change

- Willing to consider a different, proven approach

These are employers who want:

- To cut costs

- To control continuously rising health insurance expenses

And seek:

- A significant cost advantage over their competitors

- An improved health insurance experience for their employees

- Simplicity and ease

When should I consider CorePlus?

Every day counts.

CorePlus can save your company 10-25% in health insurance costs, which are your #2 expense (behind wages). In every instance that CorePlus has been implemented, companies have saved 20-25%.

If your company spends $20 million on health insurance every year, then a conservative estimated savings of 15% would mean your company would save $3 million per year, or $15 million over the next 5 years.

In other words, that’s $8,200 per day. Where else would you find that kind of money in your pocket — continuously? (And note that most companies have saved over 15%.)

Every day that you delay CorePlus is money foregone.

What do employees think?

For companies who have already used CorePlus, the result of an employee satisfaction survey showed that on a scale of 1-5, employee satisfaction was rated 4.5.

The CorePlus experience is simple, helpful, and powerful.

Why should I consider CorePlus?

- Huge cost savings (10-25%) over your current model

- Employees pay less for health insurance

- No more surprise medical bills

- Higher quality health care

- Simple and easy, for both administrators and employees

- Competitive edge:

| Several Fortune 500 companies have become leaders in their industries by implementing this solution, saving millions of dollars and providing a significant advantage against their competitors. |

Simplicity and cost certainty

Life is complicated enough, and we all know how complicated health insurance is. The #1 and #2 questions received by customer service representatives are:

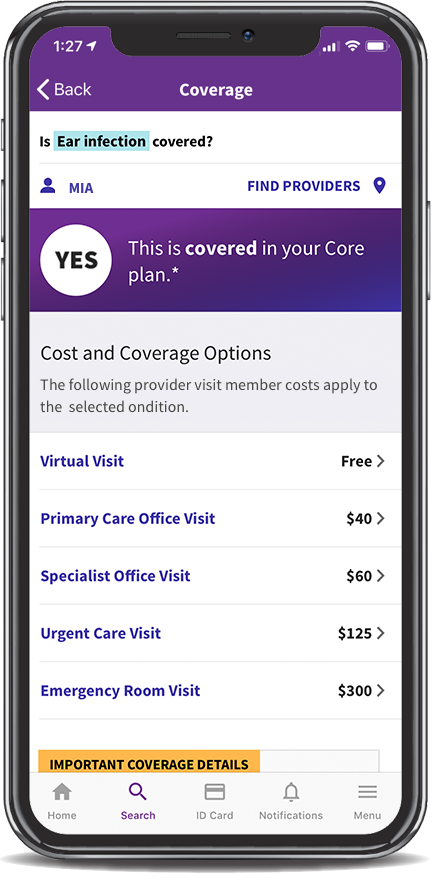

Even when we do our due diligence, the actual cost often differs significantly from the estimated cost. With CorePlus, you can easily find out what services are covered and how much it’s going to cost you. The keyword is easy. For example, look it up on your phone or call customer service to speak with a real, live person. Prices are clearly listed – no deductibles, no coinsurance. Easy peasy. |

|

|

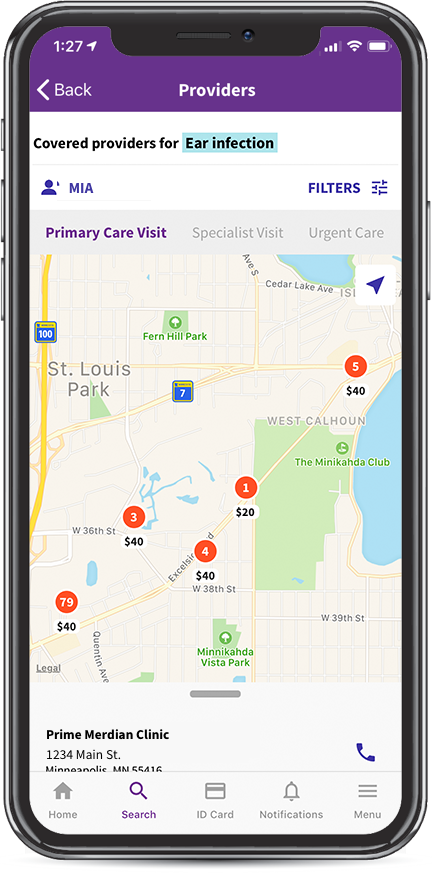

Where to go to get medical care? Again, check your phone app for a map of providers along with prices.

It’s like comparing gas prices at various gas stations on Google Maps. No more surprise medical bills. For the 67% of Americans who worry about unexpected medical bills and the 57% of Americans who have received surprise medical bills, the CorePlus promise of no surprise medical bills will be a relief. |

Lower costs for employees

In a typical health plan:

- 43% can’t afford their deductible

- 44% put off medical care due to high out-of-pocket costs

With CorePlus, employees pay less:

- 99.8% pay less than their out-of-pocket limit

- 20% would have hit their out-of-pocket maximum in a traditional plan

Furthermore:

- 96% pay less than $2,000 per year

- 91% pay less than $1,000 per year

- 79% pay less than $500 per year

How does CorePlus work?

Purchase only what you need. Cut out overinsurance.

Traditional health insurance charges high premiums in order to cover many “just-in-case” scenarios. However, this means that many people are overinsured for procedures that they will never use.

CorePlus saves money by removing this small set of procedures that are expensive and non-urgent. When needed, these procedures can be added on by the patient at that time. These procedures are kept out of Core insurance to keep costs low, but you can add them at any time.

In other words, CorePlus covers a core set of health care services (all basic health care needs1), plus a set of add-on health procedures that can be purchased on an as-needed basis.

Pay for extra services when you need it. Don’t pay for overinsurance. Only 3-8% of the population needs to buy add-on coverage.

With CorePlus, affordability is achieved without any cost shifting to employees nor any reduction in their benefits. Now that’s definitely an improvement.

Health care that is cost-effective

Another way that CorePlus works is by improving cost-effectiveness. Right now, employees with a health condition would typically be provided a variety of treatment options without data on which treatments are most effective and without data to compare prices of various treatment options. Many patients are operating pretty blindly with regards to their treatments’ out-of-pocket costs and effectiveness.

With CorePlus, patients can compare costs and treatments, including lower-cost options that they may otherwise not be aware of. Costs are clear in advance, and treatment options are easy to compare.

It benefits both the employee and employer to drive employees toward cost-effective treatments.

CorePlus increases the cost-effectiveness of treatments by providing data on and incentives for (1) lower-cost, effective treatments (e.g., physical therapy versus surgery), as well as for (2) providers at the intersection of higher safety ratings with lower prices.

The difference with CorePlus is the provision of (1) data for the patients to make informed choices about their health care, treatment options, and costs, and (2) incentives for patients to seek the more cost-effective treatment.

At all times, consumers maintain choice. With CorePlus, they have the additional advantage of informed choice.

As a result, CorePlus members select more proven and effective treatments up to 40% more often than members in traditional plans. And they select lower cost pharmacies 20% more frequently.

Next steps

Schedule a phone call to talk to one of our consultants. Let us show you how CorePlus would work for your company and your particular situation. Click below to schedule a 15-minute presentation at your convenience.

Footnote

- Core services include preventive care, primary care, specialty care, chronic conditions, maternity care, hospital stays, 24/7 virtual care, prescription drug coverage, and emergency care.

Michelle Cheuk has her B.A. in Sociology from Wellesley College and M.A. in Sociology/Demography from University of North Carolina, Chapel Hill. At UBF, she is focused on marketing, business development, and project management. In her spare time, she enjoys parenting, going to the gym, and volunteering.

Comments are closed here.