Today’s average health insurance deductible is $3,000. When 58% of Americans have less than $1,000 in savings1 and 78% of U.S. workers are living paycheck to paycheck, this is unaffordable.2 Moreover, health insurance costs keep rising. Yet again, you will have to tell your employees that health insurance rates have increased.

Aren’t you tired of that routine?

If insanity is doing the same thing over and over again but expecting a different result, the annual ritual of paying increasing health insurance costs does not make sense. Let’s admit it: Deductibles don’t work. Employees don’t know how much their medical care costs, the costs are still too high, and their health is not improved.

Why deductibles don’t work

Deductibles were introduced to share the cost burden. The idea was that people would select and consume health care more carefully when they had to cover 100% of their treatment costs from the get-go. But two things happened: (1) people didn’t know the cost of treatment options, and (2) deductibles increased year after year because they weren’t working.

What does work

| What works is health insurance that is simple, easy, helpful, clear, flexible, and affordable. Employees want to be able to control and make decisions about their health insurance costs. Employees thrive when their needs and desires are supported. For health care, that means making it easy for people to understand their treatment options and costs.

Wouldn’t it be a refreshing change to stand in front of your employees and tell them you have a solution that can lower their health insurance costs? So, what does that solution look like? How does it work? |

67% worry about unexpected medical bills357% have received surprise medical bills4 |

Simple, clear pricing. No surprise medical bills.

If everyday commodities were priced the way health care is, our morning latte from our favorite coffee shop might cost between $5 and $500, and we wouldn’t know the actual price until the “explanation of coffee benefit” showed up in the mail weeks or months after we drank it. Thanks to coinsurance and deductibles, that’s the insanity of health insurance pricing for consumers. People find out what they owe weeks after they consume care.

If you want a real win, you should consider CorePlus, which makes clear what the options and costs are before treatment. The pricing is simple. Copays only — no deductibles, no coinsurance. It’s that easy and clear.

|

|

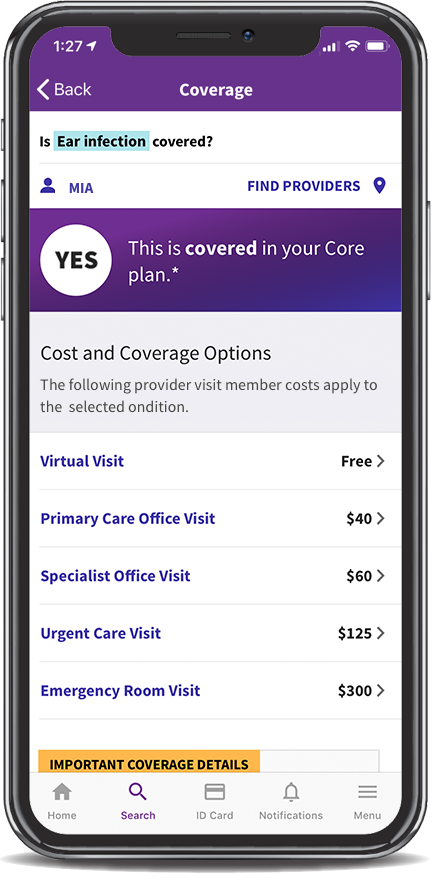

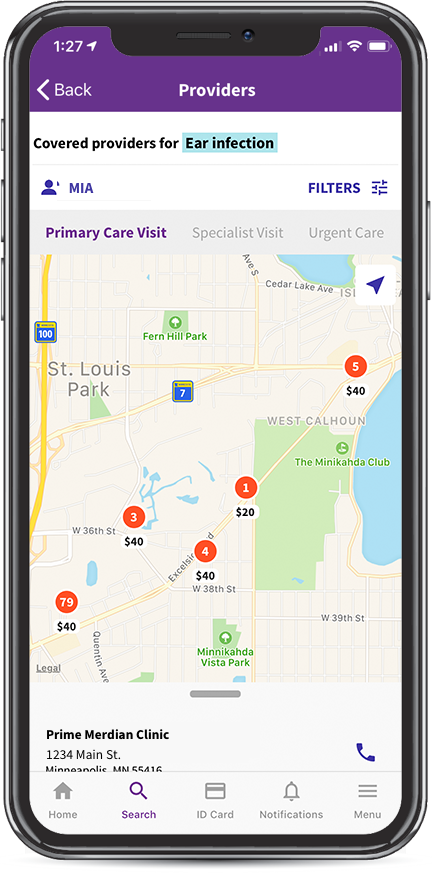

The #1 and #2 questions received by health insurance customer service are:

- Is it covered?

- How much does it cost?

With CorePlus, employees instantly review their options in an app or call our support team. With the app, browsing options is as easy as online shopping. Tap and click, compare costs and treatments, including lower-cost options that they may not otherwise be aware of. Costs are clear in advance. Treatment options are easy to compare. If employees want to speak to a live human being, an extensive phone support team is available to walk them through their options and answer their questions.

Cost and effectiveness are aligned

It’s not over-utilization that drives up cost; it’s the wrong utilization. CorePlus members select more proven and effective treatments up to 40% more often than members in traditional plans.

For example, members try physical therapy and less invasive options before, or instead of, costly surgeries. The same cost-effective selection occurs for treatment facility. CorePlus members select outpatient clinics or ambulatory surgical centers up to 92 percent more often than inpatient hospitals. People who are enrolled in CorePlus select lower-cost pharmacies 44 percent more often than members in traditional plans. These behavioral changes are helping employers curb health care costs as much as 10-20%.

Core insurance plus add-on insurance

With CorePlus, there is a set of Core services such as preventive/primary/specialty care, hospital stays, and emergency care. The Plus part of CorePlus is add-on, select medical procedures. These procedures are kept out of Core insurance to keep costs low, but you can add them at any time when needed.

In addition, CorePlus takes into account that some health care providers are more effective at certain procedures than others, and some providers cost less than other providers. Incentives are provided for choosing more effective health care providers and/or lower cost providers. Cost and effectiveness are aligned: less effective treatments cost more, more effective treatments cost less.

Appropriate care costs less

Employees shouldn’t be afraid to use their health insurance. One study found that 44% of people have put off medical care due to high out-of-pocket costs.5 When employees put off the care they need, employers pay the price — an estimated $530 billion due to illness-related productivity loss.6 When care is more affordable, then employees are more likely to seek appropriate care. The result of affordability is consumption of health, not avoidance of care.

A good example is prescription drug utilization. When people need medication, they should be encouraged, through plan design and experience, to obtain it in the right form and from the right source. With CorePlus, that happens. Under our plan, 41 percent use their pharmacy benefit, compared to 29 percent under traditional plans. That means more people are getting the drugs they need, and they’re doing it at an average cost of $37.74 per member per month compared to the industry average of $69.83.

With CorePlus, employees pay less out-of-pocket:

- 99.8% pay less than their out-of-pocket limit

- 20% would have hit their out-of-pocket maximum in a traditional plan

- 96% pay less than $2,000 per year

- 91% pay less than $1,000 per year

- 79% pay less than $500 per year

It’s time to reevaluate your health care options

Real change in health care costs requires an innovative plan design that focuses on empowering the consumer to make good treatment choices, not the same old plan wrapped with a different bow. It’s time to think outside the box and embrace CorePlus.

Book a call at your convenience to learn how CorePlus can simplify your health insurance and save you money:

Sources

- https://www.gobankingrates.com/saving-money/savings-advice/58-of-americans-have-less-than-1000-in-savings

- https://www.forbes.com/sites/zackfriedman/2019/01/11/live-paycheck-to-paycheck-government-shutdown/#45665ae14f10

- https://khn.org/news/surprise-medical-bills-are-what-americans-fear-most-in-paying-for-health-care

- https://www.modernhealthcare.com/article/20180830/TRANSFORMATION01/180839993/more-than-half-of-americans-have-received-a-surprise-medical-bill

- https://www.forbes.com/sites/brucejapsen/2018/03/26/poll-44-of-americans-skip-doctor-visits-due-to-cost/#36a177776f57

- https://www.ibiweb.org/poor-health-costs-us-employers-530-billion-and-1-4-billion-work-days-of-absence-and-impaired-performance

Michelle Cheuk has her B.A. in Sociology from Wellesley College and M.A. in Sociology/Demography from University of North Carolina, Chapel Hill. At UBF, she is focused on marketing, business development, and project management. In her spare time, she enjoys parenting, going to the gym, and volunteering.

Comments are closed here.