Health care is the #2 cost for companies (behind wages), consuming 7.6 percent of company budgets.1 And insurance premiums keep rising rapidly every year. For many companies, the cost of health insurance is becoming increasingly unaffordable. Companies spend an average of $8,669 per employee annually on health care,2 and 77 percent of companies saw increases in their health care spending.3

As you begin to review your company’s health care spending for next year:

- Are you willing to consider new ideas to old problems?

- Are you interested in offering innovative benefit solutions for your employees?

- Do you place special value on consumerism, transparency, and minimizing health care waste?

New ideas to old problems

| If you answered yes to any of these questions, then consider CorePlus, a solution set that is a game changer that will cut your insurance costs and improve your employee health care experience. The CorePlus solution provides an opportunity for you to eliminate waste, improve care, and significantly lower costs. |

Save 10-20% in health care costs |

Our transformative approach has saved 10-20% in health care costs for a number of companies, including a national Fortune 500 manufacturer, a large medical device company, and a well-known electronics retailer. With no cost shifting and no reduction in benefits. For one company, this translated to a reduction of their $100 million annual health care spending by 15%, or $15 million per year. For another company, CorePlus reduced their $20 million annual health care spending by 20-25%, saving them $4-5 millon per year.

CorePlus reduces health care costs and simplifies health insurance so that you can improve your bottom line and make your employees happier.

Past strategies to manage healthcare spending:

Shifting the chairs on the deck

Let’s review the strategies that companies have used in the past to manage health care costs, and then let’s see the paradigm shift that CorePlus has to offer.

Past efforts at reducing health care spending have primarily centered around consumer-directed plans and population health strategy to manage risk. It has been the same story over the past decade, moving the same benefit levers. The approach is shifting the chairs on the deck in an attempt to stem the rising tide of health insurance costs. Some of these strategies probably sound familiar:

- Offer new hires less coverage than current employees

- Shifting costs to employees

- HMO plans

- High deductible health plans (HDHP)

- Variety of PPO plans, including high and low deductibles and co-pays

- Tiered health insurance plans

- Changing prescription drug benefits

- Consumer-directed health plans (e.g., health savings accounts (HSA), health reimbursement arrangements (HRA))

- Wellness programs to improve employee health

- Programs to increase employee responsibility for their health

- Limiting or increasing cost-sharing for spousal health insurance coverage

- Auditing family-member eligibility

- Consolidating third-party vendors or pooling insurance risks for economies of scale

- Telemedicine and nurse hotlines

- Self-funding

- Scaling back or eliminating retiree benefits

- Eliminating health insurance coverage altogether

However, these past strategies for saving money on health insurance are simply cutting and shifting pieces of the same pie. Either companies pay for the rising costs, employees pay a higher share of the rising costs, or companies try to reduce medical costs by improving employee health.

Improving benefits and reducing costs

Improving benefits for employees has been a long-standing goal of UBF Consulting. CorePlus is a health plan solution rewired, powered by an agile and simple consumer experience. And it costs 10-20% less than your current model.

It takes a different type of company to be open to and understand this innovative, transformative approach. We have identified a streamlined solution to save on costs and help you be more savvy about purchasing your health care. We are not product pushers. We are strategic, consultative advisors. Our service zeroes in on eliminating waste, giving employees choice, and providing better outcomes. This is good for business and good for employees. And we can drive value on Day 1.

Consumers were asked:

The #1 and #2 questions received by customer service representatives are:

- Is it covered?

- How much does it cost?

The power of savings and simplicity

As many of us know, 20% of people drive 80% of insurance cost. Most people are overinsured, paying for coverage of services that they don’t need or use. Employers and employees are paying a lot for “just-in-case” health insurance. Instead, pay only for what you use. Don’t pay for what you’re not using. Pay for coverage only when you need it, and don’t overpay for health insurance. Flexible coverage that adjusts to one’s needs.

With CorePlus, there is a Core set of services:

|

|

|

There is no deductible and no coinsurance. Simple.

10-20% savings.Transparent pricing.No surprise medical bills. |

The Plus part of CorePlus is add-on, select medical procedures. These procedures are kept out of Core insurance to keep costs low, but you can add them at any time.

In addition, CorePlus takes into account that some health care providers are more effective at certain procedures than others, and some providers cost less than other providers. Incentives are provided for choosing more effective health care providers and/or lower cost providers. Cost and effectiveness are aligned: less effective treatments cost more, more effective treatments cost less. |

At all times, consumers maintain choice. With CorePlus, they have the additional advantage of informed choice. As a result, CorePlus members select more proven and effective treatments up to 40% more often than members in traditional plans. And they select lower cost pharmacies 20% more frequently.

Affordable

Consumers want affordable coverage. Currently, 43% cannot afford their deductible.4 They want help lowering their costs. With choices, and information to make those choices, consumers are able to reduce their out-of-pocket costs. With CorePlus, employees pay less out-of-pocket:

- 99.8% pay less than their out-of-pocket limit

- 20% would have hit their out-of-pocket maximum in a traditional plan

- 96% pay less than $2,000 per year

- 91% pay less than $1,000 per year

- 79% pay less than $500 per year

Moreover, when care is more affordable, then employees are more likely to seek appropriate care. One study found that 44% have put off medical care due to high out-of-pocket costs.5 The result of affordability is consumption of health, not avoidance of care.

With CorePlus, affordability is achieved without any cost shifting to employees nor any reduction in their benefits.

Transparent pricing. Easy and clear.

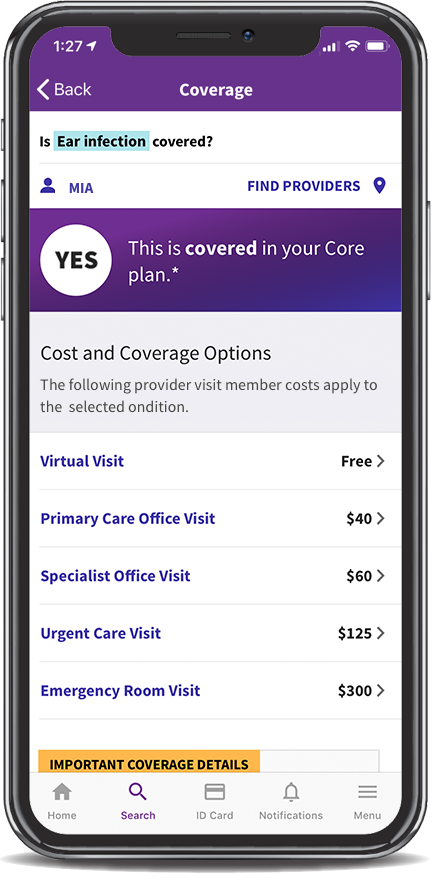

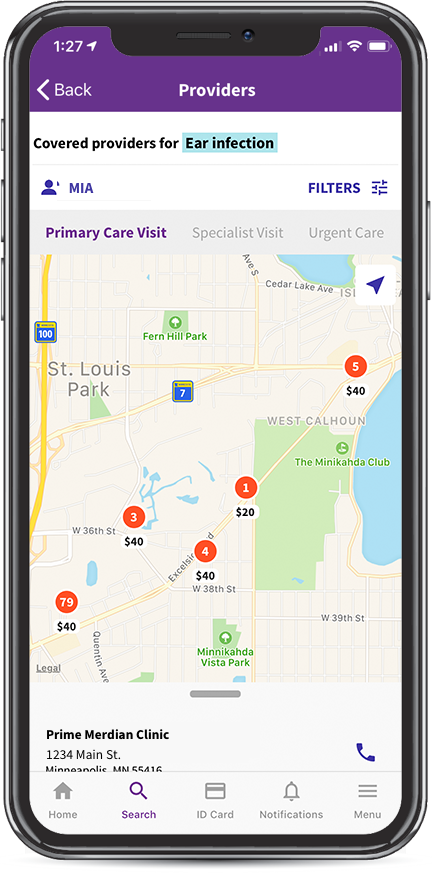

As mentioned earlier, the #1 and #2 questions received by customer service representatives are (1) tell me what’s covered and (2) tell me what it costs. Consumers want health insurance plans to make it easy to see their options.

Marketplaces thrive when they support what consumers want. For health care, that means making it easy for people to understand their treatment options and costs. Currently, 67% worry about unexpected medical bills,6 and 57% have received surprise medical bills.7

With CorePlus, the pricing is simple. Copays only — no deductibles, no coinsurance. It’s that easy and clear.

|

|

Employees can use an app to review their options in an instant, or make a call to our support team. With the app, browsing health care options is as easy as online shopping. Tap and click, compare costs and treatments, including lower cost options that they may not otherwise be aware of. Costs are clear in advance. Treatment options are easy to compare. Coverage is adjustable.

Consumers are empowered with informed choices, no surprises, and cost and coverage certainty. The result is a more satisfying experience.

Helpful support

CorePlus provides very extensive customer service by phone and online tools to ensure clarity and informed choice. Employees will have instant answers about what’s covered, what everything costs, and how to find high-quality health care providers.

For companies who have already used CorePlus, the result of an employee satisfaction survey showed that on a scale of 1-5, employee satisfaction was rated 4.5.

The CorePlus experience is simple, helpful, and powerful.

Ready to be impressed?

Book a 15-minute slot at your convenience, and let’s talk about how we can help reduce your health insurance costs while improving your benefits. Here is a link to our calendar.

Sources

- https://www.benefitspro.com/2016/09/02/health-care-takes-up-7-6-percent-of-employer-budge/?slreturn=20190628223019

- https://www.shrm.org/about-shrm/press-room/press-releases/pages/2016-health-care-benchmarking-report.aspx

- https://www.shrm.org/resourcesandtools/tools-and-samples/toolkits/pages/managinghealthcarecosts.aspx

- https://money.cnn.com/2017/08/05/news/economy/high-deductibles-insured-health-care/index.html

- https://www.forbes.com/sites/brucejapsen/2018/03/26/poll-44-of-americans-skip-doctor-visits-due-to-cost/#36a177776f57

- https://khn.org/news/surprise-medical-bills-are-what-americans-fear-most-in-paying-for-health-care/

- https://www.modernhealthcare.com/article/20180830/TRANSFORMATION01/180839993/more-than-half-of-americans-have-received-a-surprise-medical-bill

Michelle Cheuk has her B.A. in Sociology from Wellesley College and M.A. in Sociology/Demography from University of North Carolina, Chapel Hill. At UBF, she is focused on marketing, business development, and project management. In her spare time, she enjoys parenting, going to the gym, and volunteering.