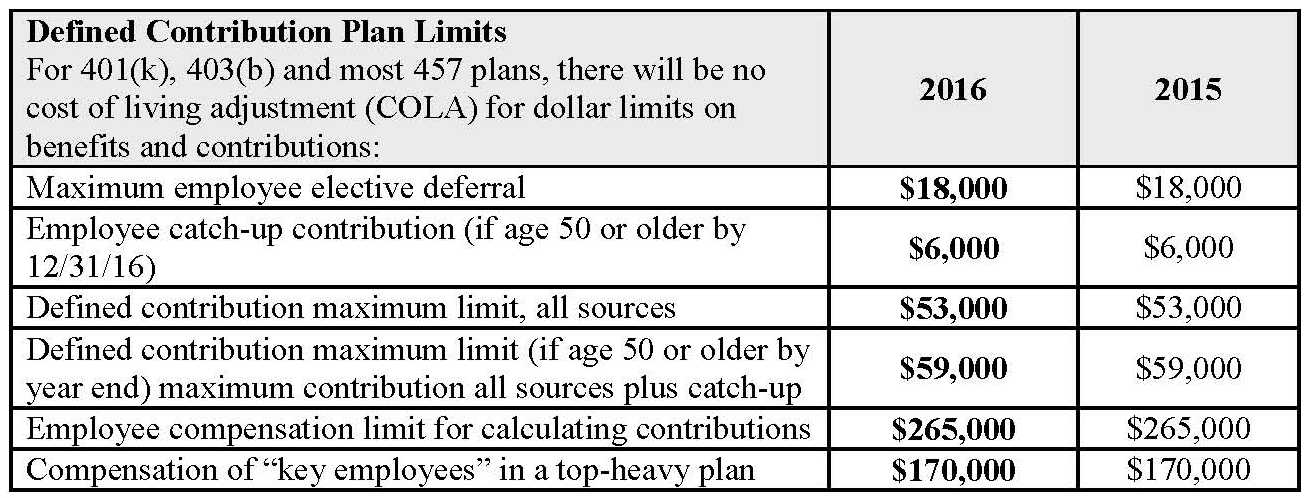

The annual limits and maximums for 401(k) and similar defined contribution retirement plans will stay the same for 2016. One of the main reasons for no contribution increase is because the cost of living rate did not increase enough to trigger any rate adjustments for 2016.

The IRS highlighted the maximum guidelines, which will take effect on January 1, 2016 per the chart below:

The annual limit for contributions to an IRA will also remain the same in 2016, staying at $5,500 with the catch-up contribution for those over 50 remaining at an additional $1,000 per year.

HR and Management should pass along this information on these contribution limits for 2016 to their employees, reminding them of the pretax contribution benefits to saving for retirement through the company offered retirement plan. Although the contribution levels are not increasing next year, employees should be encouraged to save for their retirement through the company plans that offer participants sufficient rates of return on their invested contributions in addition to the tax savings.

Eileen has practiced HR for over 30 years and has served in both large companies and boutique companies, including Disney, Hasbro, and Umpqua Bank. She currently serves on the board of directors for the EDD/EAC as well as the NCHRA. A Bay Area native, Eileen enjoys visiting Lake Tahoe, reading, and spending time with her family.